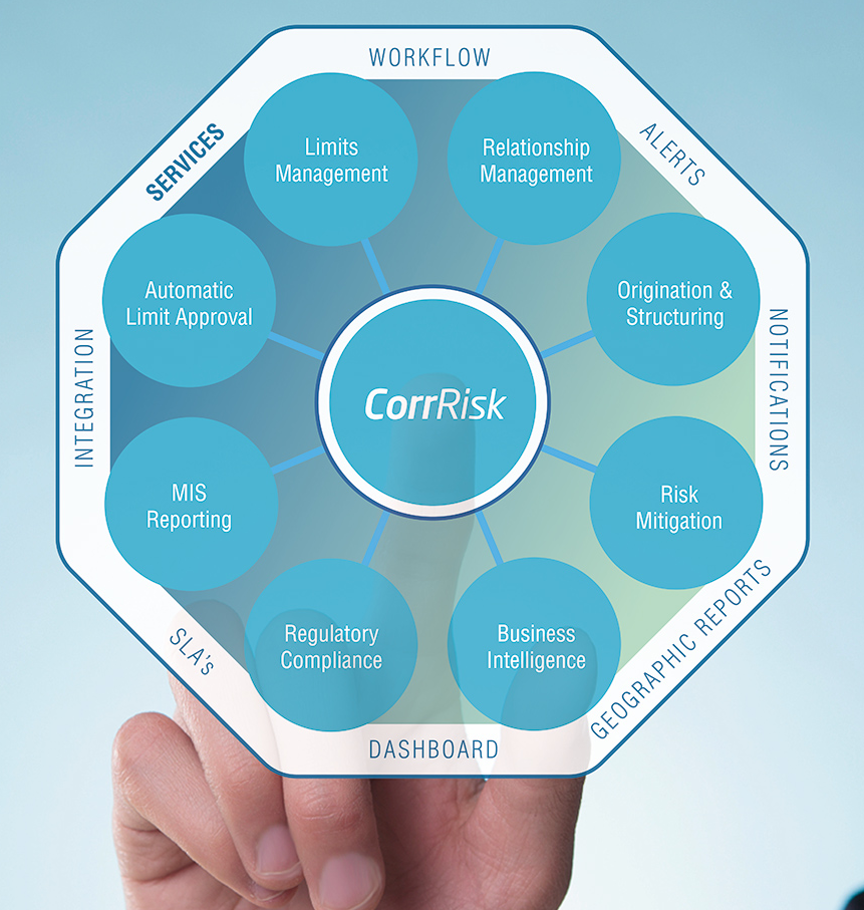

CorrRisk Provides

- Global enterprise-wide Trade Risk consolidation that allow financial institutions to have an accurate and real-time view of their global counter party and country exposures.

- Automation and standardization of cross-group processes and workflows that improve efficiency, control and the overall turnaround time of the financial institutions’ trade finance business.

- Robust trade limits management functionality that allows financial institutions to define, control and aggregate complex, financial institution-wide trade limits structures.

- Integrated Trade Asset management functionality which enables financial institutions to perform Risk Mitigation/Participation activities in the secondary market while managing and tracking profitability associated with the transactions.

- Powerful business intelligence and executive management reporting tools via smart graphical displays.

As a whole, CorrRisk is an essential tool for financial institutions that wish to perform Risk Mitigation / Participation in the secondary market while managing and tracking the profitability associated with the transactions. The CorrRisk solution has been deployed globally by some of the largest global financial institutions and is in use as a 24 x 7 x 365 mission critical application. It has the flexibility to support various business models that vary from regional based risk management to a centralized approach that provides full access to the financial institution’s entire global network to facilitate the origination of new deals.